Sustainability & ESG

At Raiffeisen Bank International, we aim to prioritize sustainability and ESG in our operations. Our strategy helps us set new sustainability standards in banking, encouraging responsible growth and long-term value.

Our Mission Statement for Sustainability in Banking

Our Vision 2025 emphasizes our commitment to being more than a bank by fostering superior customer experiences through continuous innovation. Rooted in our core values, the corporate sustainability strategy focuses on value creation, trust, and transformation. This is supported by our aim to conduct business in a socially responsible manner to enhance the welfare of people and organizations.

Value Creation

Value creation involves the transformation of existing resources through sustainable business practices, ESG integration, and a well-defined corporate responsibility strategy that aligns with our long-term goals.

Trust

Trust is crucial for successful banking. Through sustainable management, fair practices, and transparent reporting within our ESG reporting framework, we have earned the trust of existing customers and stakeholders.

Transformation

Transformation means tackling societal challenges and promoting the welfare of current as well as future generations.

Strategy Our Sustainability Strategy

Aligning Environmental, Social, and Governance Standards

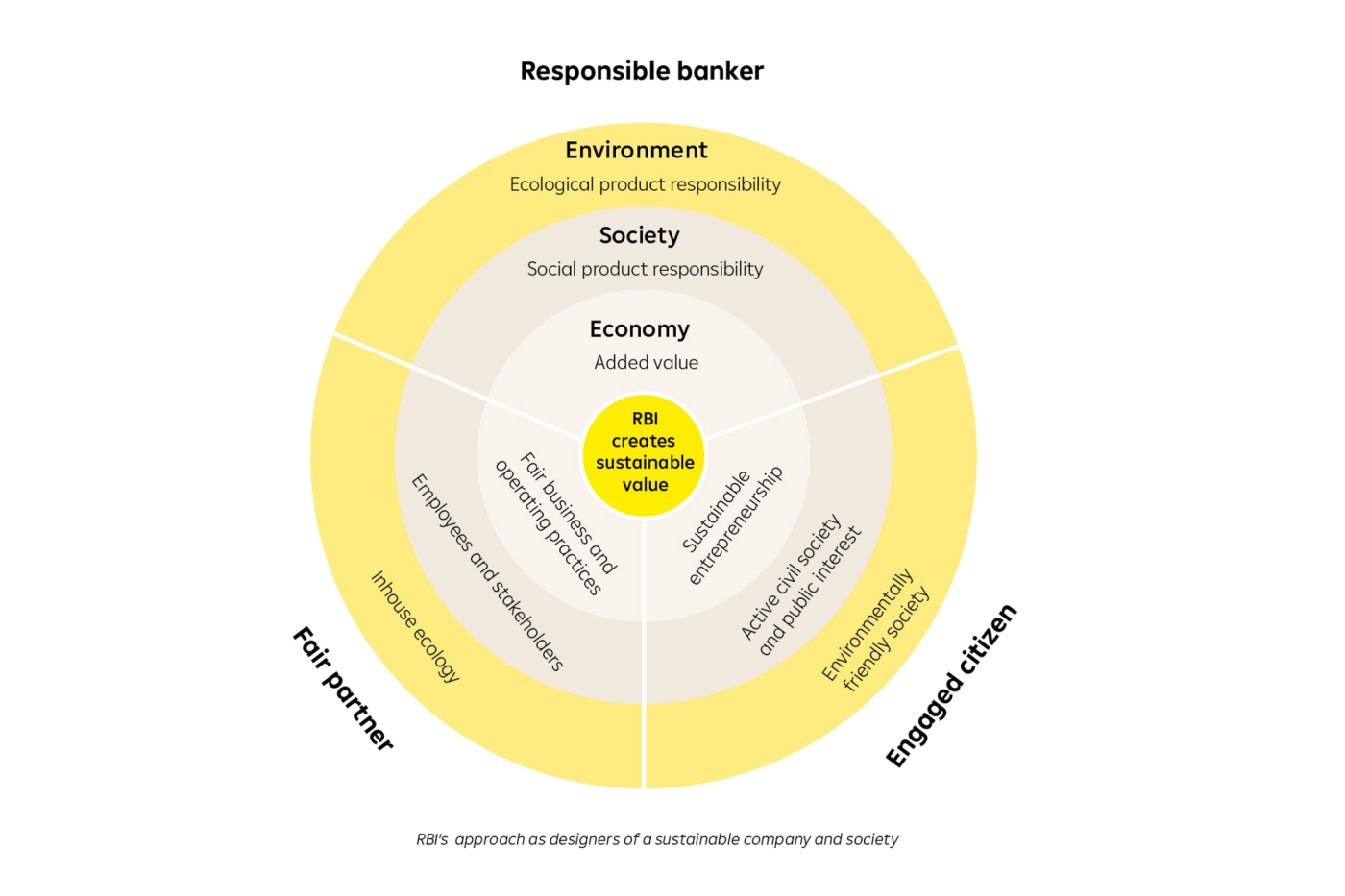

Our sustainability strategy is visually represented by a circular model, structured around three core dimensions: environment, society, and economy. These areas reflect our approach to ecological product responsibility, social impact, and the cultivation of lasting economic growth.

At the center lies our commitment to creating sustainable value through three action roles:

- Responsible Banker

- Fair Partner

- Engaged Citizen

Each of these roles aligns with ESG principles and is supported by measurable targets that promote transparency, resilience, and long-term corporate success.

Key Areas of Action

Stakeholder Engagement

Stakeholders are individuals or groups with a legitimate interest in the company — such as employees, customers, owners, suppliers, and business partners. We engage in continuous dialogue with all key stakeholder groups to strengthen responsible business practices.

Sustainability Reports & Policies

Sustainability Disclosure

The publication of our sustainability reports are an important transparency and information tool in the dialogue with our stakeholders. Furthermore, we have various policies in place covering topics such as Gambling, Nuclear Power, Defense and Thermal Coals.

ESG Ratings & Indices Ratings of Our ESG Performance

Our ratings and indices reflect our standing in key ESG benchmarks, emphasizing our commitment to environmental corporate governance and responsible investing.

Contact Us About Sustainability & ESG

Send us your questions and suggestions to sustainabilitymanagement@rbinternational.com.