Community Investment Financial Health

Sound financial decisions are key for the improved welfare of individuals and society alike. Statistics prove that many households are struggling with financial difficulties — especially in the current global economic situation.

Financial literacy

Financial literacy is defined by the OECD (Organisation for Economic Co-operation and Development) as a combination of financial awareness, knowledge, skills, attitudes and behaviors necessary to make sound financial decisions and ultimately achieve individual financial well-being.

Even though it is never too late, the greatest impact is obtained when financial literacy skills are developed from an early age to support healthy decisions over a lifespan.

Raiffeisenbank Czech Republic Financial Education With Minecraft

Learning about the fundamentals of money, good financial habits and other vital financial topics is one of the most important skills that a young teenager can acquire. However, there is only little interest. Therefore, RBI continuously strives to improve the way financial education is taught. Over the last months, RBI has been developing an interactive and engaging way of teaching critical financial aspects and terms to young students, using the Minecraft Education Edition.

Why minecraft?

Minecraft is well known at nearly all ages and hundred of schools already use the Education Edition of Minecraft to teach for example geology or art. Furthermore, it is easy to get.

By using a gamified experience instead of traditional educational lessons, we at RBI hope to better interact and engage with Gen Z and Gen Alpha, respectively. We strongly believe that with RBI’s offer of a unique and interacting way of learning more complex topics through gaming, we will have a higher chance of improving the students’ financial literacy. In fact, our last feedback sessions with high-school students in Austria and Slovakia support this idea.

How do schools use the game?

Our goal is to provide schools with the ability to host an interactive and engaging session for kids between the ages of 10 and 15. That is why each “minigame” is designed to have the playtime of approximately 30-40 minutes, enough for one teaching lessons.

Since the game is designed to be played in classrooms, it does not offer a full “self-learning” experience. Rather, the game requires a teacher or a presenter to moderate the players, give hints and further explain some game concepts. It is supposed to be an interactive session, where the players are guided through each level.

Anyone with an already existing Microsoft Office 365 account only needs to log in into Minecraft Education Edition and can directly play our game “My Finance Quests”. If you don’t have an Office 365 account or need a license to be able to play the game, please don’t hesitate to contact us under nikoletta.kovacs@rbinternational.com. Nikoletta Kovacs, Leader of Retail ESG business development.

Minecraft Raiffeisenbank Czech Republic

Raiffeisenbank has just launched an innovative project to support financial education and cyber security in the Minecraft Education environment! This makes Raiffeisenbank the first Czech bank to enable children to learn about the world of finance in this fun and modern way.

The focus of the game lies on 3 main topics: How a Bank works, Saving & Budgeting and Online Security. Each topic features its own level, with a respective storyline, with unique game mechanics, NPC interactions (NPC Interactions is a feature allowing users to set up dialog and chat with Non-Player Characters.) and engaging quests. This means that each main topic will act as its own “minigame”, that is designed to be played during one school session.

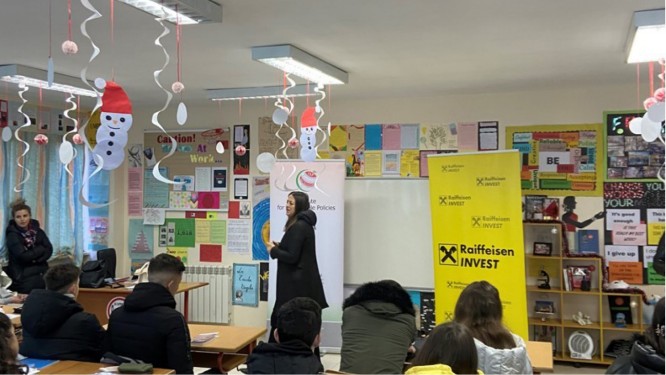

Selected Financial Education Initiatives From Our Network

Common Understanding on Financial Health & Inclusion

Together with the member banks of the UNICO Banking Forum, an international network of cooperative institutions serving over 110 million customers, we developed a common understanding on key drivers to foster customers’ financial wellbeing, addressing their financial needs, and facilitating access to essential financial services throughout Europe.

Accessibility

Our Approach to Accessibility

We are committed to providing accessible digital and physical services for everyone. This includes:

- The elimination of barriers online and in physical spaces.

- The promotion of an inclusive culture through easy access to resources, support, and services.

- The empowerment of every individual in their financial journey — regardless of disabilities.

Contact Us About Financial Literacy

Send us your questions and suggestions to sponsoring@rbinternational.com.